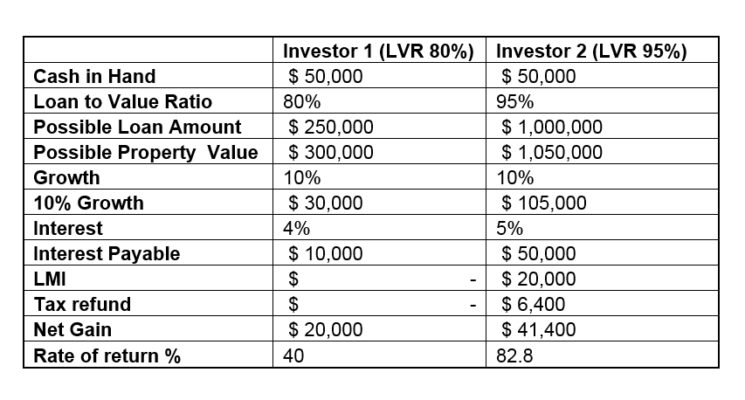

Is paying LMI worth it? The answer is, it depends on your circumstances. Yes, most of the time it is worth it, because you can utilise LMI to get into the market earlier since you have to pay less than 20% deposit, or you can use the extra money you have to diversify your investments. As you can see above, utilising the same amount of money, different investors can get different outcomes. It’s just you need to know the best way to invest your money. It is more complicated than this since each individuals’ circumstances are different and your capacity to borrow money also differs. You might even be able to spread out and buy 2 or 3 properties, instead of 1, possibilities are endless depending on your borrowing capacity and other circumstances. That is why you need to talk to a qualified professional.

This is general advice only, to show you the potential. To discover your possibilities speak to a qualified Accountant and a mortgage broker.